(Reuters) – Dollar Tree Inc trimmed its full-year profit forecast on Thursday, blaming planned price cuts at its Family Dollar line of stores in an effort to compete with other retailers that have been ramping up discounts.

Shares of the discount store operator dropped more than 8% in premarket trading.

Elevated inventory levels at Walmart Inc and Target Corp have forced the retail chains to clear excess stocks by offering deep discounts, which analysts have said could limit the number of customers trading down from traditional retailers to off-price stores.

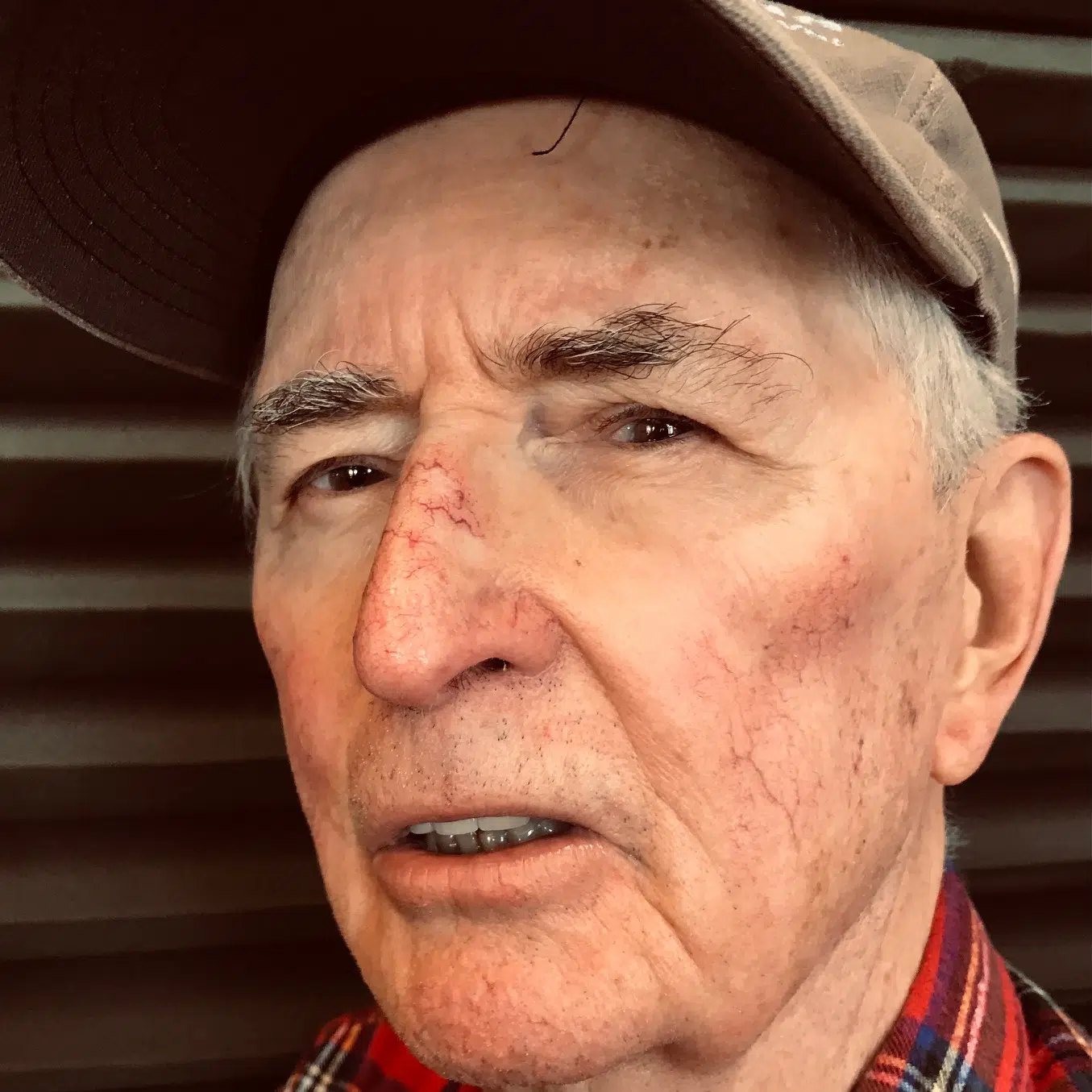

“Competitive pricing at Family Dollar will over the long term enhance our sales productivity and profitability, and ultimately our opportunity to accelerate store growth,” Dollar Tree Chief Executive Officer Mike Witynski said.

The discount retailer projected fiscal 2022 profit between $7.10 and $7.40 per share, compared with $7.80 to $8.20 per share estimated previously.

Same-store sales rose 7.5% in the second quarter, compared with analysts’ estimates for an about 5% increase, according to Refinitiv IBES.

(Reporting by Deborah Sophia and Uday Sampath in Bengaluru; Editing by Maju Samuel)